What Are Bond Yields

What are bond yields and how do they impact mortgage rates?

In the world of mortgage rates, staying ahead of market trends is paramount. Imagine having the power to predict shifts in fixed mortgage rates days, or sometimes weeks, before they happen.

Seasoned mortgage professionals know that this is actually possible through an understanding of Canadian bond yields. For brokers, interpreting bond yield dynamics isn't just about foresight - it's about strategic decision-making and superior client service.

In this issue, we explore the impact of Government of Canada bond yields on the mortgage market, specifically in how they can help us predict general movements in fixed mortgage rates and enhance our value proposition to our clients.

Bond yield basics - what are they?

Before we can begin talking about bond yields, we first need to understand bonds themselves. Bonds are essentially low-risk loans that investors provide to governments, municipalities or corporations.

When an investor purchases a bond, they are lending money to the issuer for a specified period. In return, the issuer promises to repay the principal amount at a future date, known as the maturity date, and to pay periodic interest payments, known as coupon payments, throughout the bond's life.

Knowing the basics of bonds lays the foundation for understanding bond yields, which represent the returns investors earn from holding bonds. This yield can fluctuate based on several factors, including changes in interest rates, the creditworthiness of the borrower, and the overall economic environment.

Bond yields move inversely to bond prices. So, when bond prices rise, yields fall, and vice versa. This relationship exists because as bond prices increase, the fixed interest payments become a smaller percentage of the bond's price, thus reducing the yield. Conversely, when bond prices decrease, yields rise to compensate investors for the lower price.

For example:

In the case of a 5-year bond with a cost of $1,000 and an annual coupon payment of $50 (and thus a yield to maturity of 5.0%), here's what would happen in the event the bond price rose or fell.

If the bond price increases:

The investor still receives $50 in annual coupon payments.

Since the bond was bought at a higher price, the yield to maturity (YTM) decreases.

YTM = Annual Coupon Payment / Bond Price

YTM = $50 / $1,100 = 4.55%

If the bond price decreases:

The investor still receives $50 in annual coupon payments.

Since the bond was bought at a lower price, the yield to maturity (YTM) increases.

YTM = Annual Coupon Payment / Bond Price

YTM = $50 / $900 = 5.55%

The impact of interest rates on bond yields

As mentioned above, interest rates are a powerful driver of bond yields. When the central bank raises interest rates - as the Bank of Canada did in the aftermath of the pandemic - it becomes more expensive to borrow money, which can dampen economic growth. In response, new bonds may be issued with higher yields to attract investors, reflecting the increased opportunity cost of investing in bonds over other assets. This increase in yields causes the prices of existing bonds to drop, as they now offer lower returns compared to new bonds on the market.

Conversely, when interest rates are lowered, borrowing becomes cheaper, potentially stimulating economic growth. New bonds issued in this environment may have lower yields, making existing bonds with higher yields more valuable and causing their prices to rise.

This relationship between interest rates and bond yields is fundamental to the bond market's function as a predictor of economic trends. Rising yields can indicate expectations of higher interest rates in the future, often associated with strong economic growth and inflationary pressures. While, falling yields - which we've seen in recent months - can signal expectations of lower interest rates, possibly due to economic slowdowns or deflationary trends.

The connection to fixed mortgage rates

And now for the part you've been waiting for: what do bond yields have to do with predicting fixed mortgage rate movements?

Bond yields play a pivotal role in determining interest rates across various financial products, including fixed-rate mortgages. The correlation between the bond yields and fixed mortgage rates is simple: as the yield on bonds rise, fixed mortgage rates tend to increase, and conversely, when the yield falls, mortgage rates typically follow suit by decreasing.

When bond yields rise, it indicates an increase in the cost of borrowing for the government, which subsequently influences borrowing costs across the economy. In response, mortgage lenders adjust their rates to reflect the higher cost of funds, resulting in an uptick in fixed mortgage rates. And when bond yields decline, borrowing costs decrease, leading to lower fixed mortgage rates.

The 5-year government bond yield holds significant importance due to its direct correlation with mortgage rates. Lenders use the 5-year government bond yield as a reference point to gauge the cost of borrowing for an extended period, mirroring the duration of a typical 5-year fixed-rate mortgage.

Lenders tend to adjust fixed mortgage rates in response to sustained movements in bond yields over a considerable period, rather than reacting to short-term, erratic fluctuations. While sharp, brief movements in bond yields may grab headlines and stir speculation, they often lack the lasting impact required to prompt lenders to alter fixed mortgage rates. Instead, lenders carefully monitor trends in bond yields, assessing their longevity and significance before considering any adjustments to mortgage rates.

The typical spread between bond yields and mortgage rates

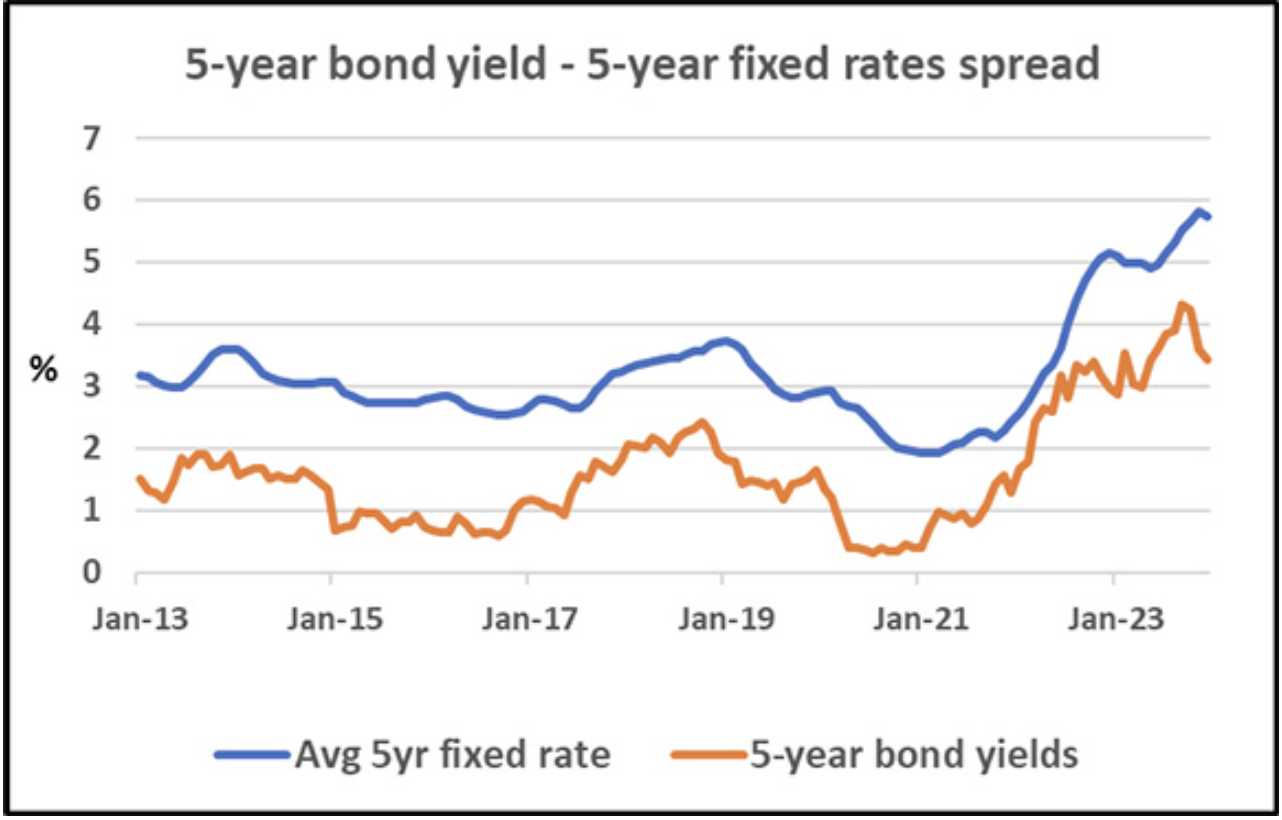

Historical data indicate a consistent relationship between Canadian bond yields and mortgage rates, with mortgage rates tending to hover around 150 basis bps above the corresponding bond yields.

With a current 5-year Canadian government bond yield of 3.63%, adding this spread would estimate a 5-year fixed mortgage rate of approximately 5.13%.

Here's how that spread looks over time:

What about terms other than 5-year yields?

The 2-year, 3-year, and 10-year bond yields can also serve as benchmarks for different segments of the bond market, and their fluctuations have distinct implications for both shorter and longer-term mortgage products, which are typically less prevalent in the Canadian mortgage market.

2-year bond yields: These yields reflect short-term interest rate expectations and are closely tied to adjustable-rate mortgages (ARMs) or variable-rate mortgages (VRMs). Lenders often price ARMs based on short-term bond yields, adjusting mortgage rates periodically in response to changes in 2-year bond yields.

3-year bond yields: Similar to 2-year bond yields, 3-year bond yields also influence short-term interest rate expectations. While less commonly used as a direct benchmark for mortgage rates, they can still impact pricing for shorter-term fixed-rate mortgages or hybrid mortgage products.

10-year bond yields: These yields are more commonly used as benchmarks for longer-term fixed-rate mortgages. Lenders typically price fixed-rate mortgages, such as 10-year fixed-rate loans, based on long-term bond yields.

The impact of the U.S. Treasury market

In addition to domestic factors, Canadian bond yields are also influenced by global economic conditions, particularly movements in the US Treasury bond market.

The US 10-year Treasury bond yield serves as a significant benchmark for global interest rates, and fluctuations in US bond yields can spill over into Canadian bond markets, impacting yields on Canadian government bonds.